-

Home

- Corporate

- Projects

- Products

- News

-

Scandium International Mining Provides Update To Shareholders

-

Scandium International Mining Announces Commencement of Physical Development of Its Nyngan Scandium Project

-

Scandium International Mining Reports Results From Drilling Program At Nyngan Scandium Project

-

Scandium International Mining Discovers New Mineralized Laterite Formation At Honeybugle, EL7977, NSW

-

Scandium International Mining Announces Voting Results from Annual General Meeting of Shareholders

-

Scandium International Mining Announces Updated Drilling Programs and Renewal of Honeybugle Exploration License

-

Scandium International Mining Presented at 1st International Scandium Symposium October 20th, 2022

-

Scandium International Mining to Present at 1st International Scandium Symposium October 20th, 2022

-

Scandium International Mining Announces Voting Results from Annual General Meeting of Shareholders

-

Scandium International Mining Announces Closing Of Third And Final Tranche Of Non-Brokered Private Placement

-

Scandium International Mining Announces Closing of Second Tranche and Upsizing of Private Placement

-

Scandium International Mining Announces Closing Of First Tranche Of Non-Brokered Private Placement

-

Scandium International Mining Announces Private Placement

-

Scandium International Mining Announces Updated Strategic Focus & Leadership Changes

-

Scandium International Issues Update On CMR Development Program With Phoenix Mine

-

Scandium International And Nevada Gold Mines Sign LOI To Pursue Critical Metals Recovery At Phoenix Mine

-

Scandium International Mining Announces Voting Results from Annual General Meeting of Shareholders

-

Scandium International Files For Patent Protection On High Purity Alumina Manufacturing Process

-

Scandium International Receives Two Patent Grants Relating To Scandium Recovery And Scandium Master Alloy Manufacturing

-

Scandium International Files Patent Application For Use Of Scandium In Lithium-Ion Batteries

-

Scandium International Receives Positive Final Determination On Nyngan Mining Lease Landowner Objection

-

Loss Of SCY Director – Barry Thomas Davies

-

Scandium International Mining Corp. Announces Voting Results of Annual General Meeting

-

SCY Seeks Copper Industry Partner To Demonstrate Scandium, Cobalt, And Other Critical Metals Recovery Technology

-

SCY Receives Favorable Government Notice On Nyngan Mining Lease Landowner Objection

-

SCY Announces Joint Program with ECK Industries to Demonstrate Impacts of Cerium and Scandium Additions in Aluminum Alloys

-

SCY Completes Program To Demonstrate AL-SC Master Alloy Manufacture Capability

-

Scandium International Receives Royalty Pay-Out

-

Scandium International Mining Corp. Announces Resignation of Board Director

-

New Mine Lease Grant Received For Scandium International’s Nyngan Project In Australia

-

Scandium International Mining Corp. Announces Voting Results of 2019 Annual General Meeting

-

Nyngan Project – New Mine Lease Application Filed

-

Nyngan Project – Mine Lease Status Update

-

SCY Receives Notice That Nyngan Mine Lease Has Been Determined Invalid

-

Scandium International Closes Private Placement Financing

-

SCY Signs Letter Of Intent With Bronze-Alu Group To Test Scandium Alloys In Casting Applications

-

Scandium International Announces Private Placement Financing

-

Scandium International Update On Patent Filings

-

Scandium International Update On Results From Eck Industries Testing Of Scandium In Alloys

-

SCY Receives Notice Of Mine Lease Review

-

Scandium International Reports on Results From Eck Industries Trials of Scandium in Alloys

-

Scandium International Signs Letter Of Intent With Austal Ltd.

-

Dr. Hasso Weiland Joins Scandium International Marketing Team

-

Scandium International Signs Letter of Intent with Pab Coventry Ltd

-

Scandium International Signs Letter Of Intent With Impression Technologies Ltd.

-

Dr. Nigel Ricketts Resigns From SCY

-

Scandium International Mining Corp. Announces Results of 2018 Annual General Meeting

-

Scandium International Closes Private Placement Financing

-

SCY Signs Letter Of Intent With Eck Industries Inc. To Test Scandium Alloys In Casting Applications

-

SCY Signs Letter of Intent With Grainger & Worrall Ltd. to Test Scandium Alloys in Casting Applications

-

Scandium International Announces Private Placement Financing

-

Scandium International Initiates Pilot-Scale Program for Scandium Master Alloy Production and Files for US Patent Protection on Process

-

Scandium International Announces Closing on Private Placement Financing

-

SCY Signs Letter Of Intent With Gränges AB To Test Scandium Alloys In Heat Exchanger Applications

-

SCY Signs Letter Of Intent With OHM & Häner Metallwerk To Test Scandium Alloys In Casting Applications

-

SCY Signs Letter Of Intent With AML Technologies To Test Scandium Alloys In 3D Printing Applications

-

Scandium International - Sales and Marketing Update

-

Scandium International Initiates EPCM Critical Path Engineering on Nyngan Scandium Project

-

Scandium International Closes Share Exchange Transaction With Scandium Investments LLC.

-

Scandium International Secures Scandium Exploration Property In Finland

-

SCY Shareholders Approve Share Exchange Agreement Between SCY And SIL

-

SCY Announces Common Share Private Placement for a Total Of C$1,088,500 in Proceeds

-

Scandium International Consolidates 100% Ownership Of Nyngan Scandium Project; Scandium Investments Llc To Become Largest Shareholder

-

Scandium International Mining Corp. Announces Results of 2017 Annual General Meeting

-

Newsfile Corp. Cross Time Report: Scandium International Mining Corp. and Lycopodium Sign EPCM Contract for Nyngan Scandium Project

-

SCY Receives Mining Lease Grant for Nyngan Scandium Project

-

SCY Enters Into Mou With Weston Aluminum For Master Alloy Manufacture

-

Scandium International Announces Receipt of A$629,000 Net Tax Refund Under the Australian Government's Research & Development Incentive Program

-

Nyngan Scandium Project Receives NSW Development Consent

-

Key Staff Appointment To Nyngan Scandium Project Team

-

Nyngan Scandium Project Confirming Process Test Results Received

-

Scandium International Mining Corp. Announces Results of 2016 Annual General Meeting

-

Feasibility Study -- Nyngan Scandium Project Filed On SEDAR

-

Scandium International Files Environmental Impact Statement In Support Of Development Of The Nyngan Scandium Project

-

Results Of Definitive Feasibility Study On The Nyngan Scandium Project In Australia

-

Scandium International Mining Corp. Announces Results of Annual General Meeting

-

Scandium International Receives Us$2.07m From Royalty Sale On Nyngan And Honeybugle Scandium Projects In Australia

-

Scandium International Initiates Definitive Feasibility Study on Nyngan Scandium Project in Australia

-

Scandium International Announces Annual General Meeting

-

Scandium International Announces Significant Transactions: Equity Financing, Debt Conversion, Joint Venture Formation on Nyngan Scandium Project, and New Board Member

-

SCY and ALCERECO Sign MOU and Scandium Offtake Agreements

-

Scandium International To File Amended Technical Report

-

Scandium International Technical Disclosure Review

-

Novel Flowsheet Design Patents Filed for Scandium Recovery

-

Final Assay Results of Resource In-fill Drilling at Nyngan Scandium Project - 357ppm

-

Early Assay Results of Resource In-fill Drilling at Nyngan Scandium Project -- 387ppm

-

EMC Announces Name Change To Scandium International Mining Corp.

-

EMC Files Preliminary Economic Assessment On Nyngan Scandium Project In Australia

-

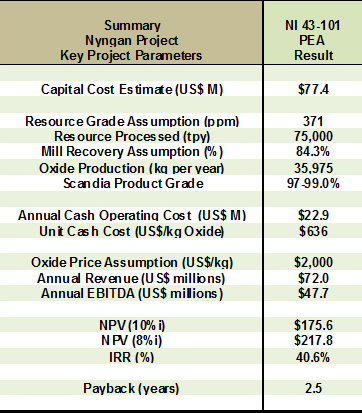

Results of Preliminary Economic Assessment on Nyngan Scandium Project in Australia

-

EMC Announces Completion of Common Share Private Placement for a Total Of C$470,425 in Proceeds

-

EMC Initiates Preliminary Economic Assessment On Nyngan Scandium Project In Australia

-

EMC Announces New Board Director

-

EMC Announces Completion of Common Share Private Placement for a Total of C$1,279,814 in Proceeds

-

EMC Announces Completion of C$885,308 First Tranche Private Placement

-

EMC Announces US$2.5M Financing To Secure Nyngan Scandium Project

-

EMC Announces $3 Million Non-Brokered Private Placement

-

EMC Metals Corp. Drills 30 Holes at Honeybugle, Intersects Average 270 PPM Scandium in 13 holes

-

EMC Announces Completion Of C$103,053 Second Tranche Private Placement

-

EMC Announces Second Tranche of Private Placement for C$103,500

-

EMC Secures New Property in NSW, Australia

-

EMC Announces Completion of C$213,000 Private Placement

-

Correction of News Release: EMC Announces C$213,000 Private Placement

-

EMC Closes C$213,000 Private Placement

-

EMC Announces USD$650,000 Loan Financing

-

EMC Formally Closes Springer Tungsten Mine Sale for US$5M

-

EMC Sells Springer Tungsten Mine for US$5M, Clearing Path to Focus on Developing Scandium Projects in Australia and Norway

-

EMC Makes First Settlement Payment on Nyngan Scandium Project, Controls 100% of Project in Australia

-

EMC Announces Resignation of Board Director

-

EMC Metals Corp. Announces Completion of Private Placement

-

EMC Announces Positive Results of 2012 Norway Exploration Program

-

EMC Settles Dispute with Jervois, Now Controls 100% of Nyngan Scandium Project in Australia

-

EMC Prepares For Court Hearings on Nyngan Scandium Project Dispute

-

EMC Now Holds 100% Interest in Tørdal Scandium and Høgtuva Beryllium Properties in Norway.

-

EMC's $8M Cash/Royalty Offer for Nyngan Scandium Project Expires

-

EMC Makes A$8 Million Offer To Acquire The Nyngan Scandium Project

-

EMC Files Positive Preliminary Economic Assessment and Updated Resource Estimate for the Springer Tungsten Mine on SEDAR

-

Update - Nyngan Project Earn In Dispute

-

EMC Receives Positive Preliminary Economic Assessment and Updated Resource Estimate for the Springer Tungsten Mine, Nevada USA

-

EMC Metals Provides Update on Nyngan Project Earn-in Dispute

-

EMC Metals Corp. Announces Completion Of Private Placement

-

EMC Metals Corp. Announces Private Placement

-

Update - Nyngan Project Earn-in Dispute

-

EMC Announces New Board Director

-

EMC Announces General Manager for Springer Tungsten Mine

-

EMC Announces New Board Director

-

EMC Announces Resignation of Board Director

-

EMC Now Working to Re-start Springer Tungsten

-

EMC Update Regarding Dispute with Jervois on Nyngan Scandium Project

-

EMC Receives Notice of Rejection on Earn-In of Nyngan Scandium Project by Jervois Mining Limited

-

EMC Completes USD$3,000,000 Loan Financing

-

EMC Announces USD$3,000,000 Loan Financing

-

EMC Receives Final Report on Pilot Plant Test-Work for Nyngan Scandium JV Project in NSW, Australia

-

Nyngan Project Conceptual Plan Submitted to NSW State Regulators in Australia

-

EMC Signs Option Agreement to Acquire Former Scandium Production Site In Utah, USA

-

EMC Metals Receives Initial Surface Assays With Up to 217 ppm Scandium at Tørdal Property in Norway

-

EMC Sells Fostung Tungsten Property to Janus Resources Inc.

-

EMC Selects Engineering Firm For Feasibility Study at Nyngan Scandium Project in NSW, Australia, Environmental Work on Project Continues

-

EMC Commences Environmental Work at Nyngan Scandium Project in NSW, Australia

-

EMC Signs Earn-In Agreement With REE Mining on Two Exploration Properties Targeting Scandium, Specialty Metals and REE's

-

EMC Appoints John Thompson to Lead Development of Nyngan Scandium Project, Australia

-

EMC Receives Initial Report on Laboratory Test Program for the Direct Production of Scandium-Aluminum Master Alloy

-

EMC Receives Initial Report on Metallurgical Test-Work for Nyngan Scandium JV Project in NSW, Australia

-

EMC Metals Completes Second Tranche Of Private Placement For $2.1 Million

-

EMC Metals Closes Private Placement

-

EMC Metals Completes $1.5 Million Private Placement

-

EMC Metals Announces Non-Brokered Private Placement

-

EMC Appoints Jordan Capital Markets Inc. as Advisor and Sales Agent for Sale of Springer Tungsten Mine Asset in Nevada

-

EMC Receives Report on Capital & Operating Cost Estimates for the Nyngan Scandium JV Project in NSW, Australia

-

EMC Announces Resignation of Board Director

-

EMC Metals Announces Close Of Non-Brokered Private Placement

-

EMC Metals Files Independent Technical Report and Resource Estimate on Carlin Vanadium Project, Nevada

-

EMC Metals Corp. Announces Resignation of Director

-

EMC Metals Receives a National Instrument 43-101 Technical Report and Resource Estimation for the Carlin Vanadium Project, Nevada.

-

EMC Metals Appoints Mr. George Putnam as Chief Executive Officer & President

-

EMC Metals files a NI43-101 Technical Report for the Nyngan Gilgai Scandium Deposit and Completes the Second Milestone in their Joint Venture Agreement with Jervois Mining Ltd.

-

EMC Metals Announces New Chairman and President

-

EMC Metals and Jervois Mining Ltd. Receive the NI 43-101 Technical Report for the Nyngan Gilgai Scandium Deposit

-

EMC Metals Commissions SRK Consulting (U.S.) Inc. to Complete a 43-101 Technical Report for the Carlin Vanadium Project

-

EMC Metals Announces Changes to the Board and Management Team

-

EMC Metals enters Agreement to Explore and Develop Australian Rare Earth Scandium Deposit

-

EMC Metals Announces Completion of Acquisition of the Technology Store, Inc.

-

EMC Announces Acquisition Of The Technology Store, Inc.

-

Closing Of Private Placement

-

EMC Metals Closes $150,000 Private Placement and Appoints New Director

-

EMC Metals Receives Resource Estimate and Work Recommendations for Springer from SRK Consulting Inc. U.S.

-

Full Payment Of Loan Received From Midway Gold

-

Golden Predator Closes $1.38 Million Private Placement

-

Golden Predator Announces $2.2 Million Private Placement

-

Golden Predator Royalty & Development Corp. Raises $4.3 Million

-

Golden Predator Provides Clarification

-

Update On Rights Offering of Golden Predator Royalty & Development Corp.

-

EMC Metals Appoints William Sheriff as Chairman of the Board

-

EMC Metals Corp. Announces Change of Management

-

Golden Predator Completes Spin-Out

-

Golden Predator Announces Voting Results of Special Meeting

-

Timing of Shareholders Meeting To be Held On March 4, 2009

-

Golden Predator to Retire Convertible Debentures of Subsidiary

-

Golden Predator Invites you to visit their booth at the PDAC 2009

-

Golden Predator Reports on Initial Exploration at Dyke Canyon Project

-

Golden Predator Confirms Date of Shareholder Meeting

-

Golden Predator Reports on Initial Exploration at High Grade Project

-

Golden Predator Initiates Exploration at Tuscarora Gold Project

-

Golden Predator Subsidiary Reports 2009 Advance Royalty Revenue of CDN$1.22 million

-

Golden Predator Provides Update on Corporate Reorganization

-

Golden Predator Reports Confirmation of High Grade Veins with Diamond Drilling, Intersecting 0.93 oz/t Gold at Adelaide Project

-

Golden Predator Announces Spin-Out of Gold Assets

-

Golden Predator's Springer Mine Receives Permitting Green Light

-

Golden Predator To Receive $1 Million; Additional $1 Million To Come

-

Golden Predator Increases Working Capital by US $ 2 Million

-

Golden Predator Intersects Multiple Tungsten Assays Greater than One Percent and Reports 3.62% MoS2 from Surface Drilling at the Springer Mine

-

Golden Predator Receives Air Quality Operating Permit for Springer

-

Golden Predator Provides Corporate Update

-

Golden Predator Intersects 1.00% Tungsten (WO3) over 11.4 Feet at Springer

-

Golden Predator Reports High Grade Intercept of 9.1 m grading 27.4 grams per tonne (30 ft of 0.8 oz/t) Gold at Adelaide Project

-

Golden Predator to Reduce Costs at Springer

-

Golden Predator Mines Inc. Announces Midway Gold Corp. Not Proceeding With Business Combination

-

Golden Predator Intersects 1.00% Tungsten (WO3) over 11.4 Feet at Springer

-

Golden Predator Intersects 1.00% Tungsten (WO3) over 11.4 Feet at Springer

-

Golden Predator completes Arrangement with Fury Explorations Ltd.

-

Exercise Of Warrants Extended To September 22, 2008

-

Golden Predator Clarifies Previous Disclosure Following Technical Disclosure Review by BCSC

-

Golden Predator Reports High Grade Intercept of 4.6 m grading 41.8 grams per tonne (15 ft of 1.22 oz/t) Gold at Adelaide Project

-

Golden Predator Intersects 11.2 grams per tonne Gold in Initial Drilling at Adelaide

-

Golden Predator Mines Inc. And Midway Gold Corp. Announce Signing Of A Term Sheet For Business Combination

-

Golden Predator Mines Inc. Appoints Larry Yau As Chief Financial Officer

-

Golden Predator Warrants Exercised For Proceeds Of $7.3 Million

-

Golden Predator And Fury Explorations Ltd. Sign Definitive Agreement For Business Combination

-

Golden Predator Intersects 0.67% WO3 over 7.04 feet in New Area at the Springer Mine

-

Golden Predator Intersects 0.390% Mo over 14.1 feet and 0.743% WO3 over 4.62 feet in Surface Drilling at the Springer Mine

-

Golden Predator Announces $5 Million Private Placement

-

Golden Predator Intersects 11.2 grams per tonne Gold in Initial Drilling at Adelaide

-

Golden Predator Intersects High Grade Tungsten Mineralization in Surface Drilling at the Springer Mine

-

Golden Predator Continues to Intersect Tungsten Mineralization in Surface Drilling at the Springer Mine

-

Golden Predator Mines Inc. Announces Transfer Of 5 Million Shares To Gmp Diversified Alpha Master Fund

-

Golden Predator to Acquire Fury Explorations Ltd.

-

Golden Predator Mines Inc. Announces Early Release Of Escrow Shares

-

Golden Predator Concludes First Ever Sale of Tungsten Concentrate from Springer

-

Golden Predator Intersects Gold Mineralization at its Modoc property in the Battle Mountain District of Nevada

-

Peter Bosse named Chief Operating Officer of Golden Predator Mines (US) and Appoints Robert Mitchell to the Technical Advisory Committee

-

Golden Predator Intersects Tungsten Mineralization in Surface Drilling at the Springer Mine

-

Springer Project Overview and Progress Report

-

Golden Predator Mines Inc. Trades On The Toronto Stock Exchange, Announces Conversion Of Special Warrants, And Completes Acquisition Of Great American Minerals, Inc.

-

Fury and Golden Predator Terminate Merger Negotiations

-

Fury and Golden Predator Agree to Merger

- Investors

- Contact

- RSS Feed

- Login

©2024 Scandium International Mining Corporation

All rights reserved.

Disclaimer